Prince Narula Digital PayPal: New Era in Payment Systems

Prince Narula Digital PayPal

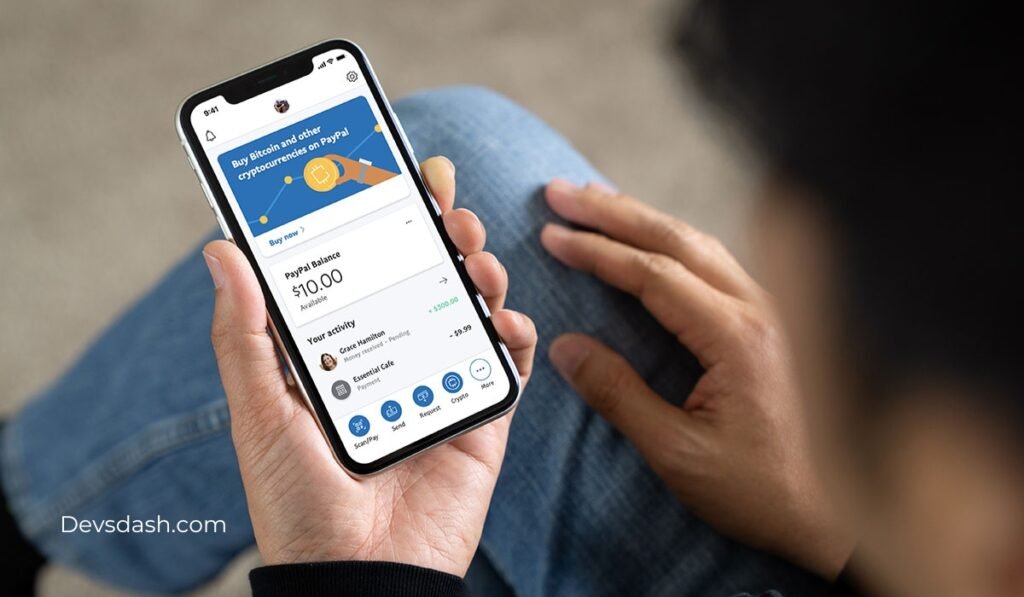

In today’s rapidly evolving digital economy, efficient and secure payment platforms are essential. Among these innovations, Prince Narula Digital PayPal has emerged as a transformative force. Designed to simplify online transactions while enhancing trust and flexibility, it has redefined how businesses and individuals engage in financial exchanges.

Whether you’re an entrepreneur managing international clients or an everyday user making purchases, Prince Narula PayPal offers robust solutions tailored to modern demands. Let’s dive deep into its features, benefits, and transformative impact on digital payments.

Prince Narula Digital PayPal: Transforming Payment Landscapes

Prince Narula Digital PayPal brings a fusion of cutting-edge technology and user-centric features to online payments. It bridges the gap between convenience and security, ensuring seamless experiences for users.

Key Features of Prince Narula PayPal:

- Global Accessibility: Works efficiently across multiple countries and currencies.

- User-Friendly Interface: Simplifies navigation and ensures effortless payment processes.

- Enhanced Security Protocols: Includes two-factor authentication, encryption, and fraud detection.

- Integrated Services: Supports invoicing, payment tracking, and financial reporting.

- Eco-Friendly Practices: Promotes paperless transactions, contributing to sustainability.

Why Choose Prince Narula Digital PayPal?

1. Seamless Cross-Border Transactions

Unlike traditional banking systems, Prince Narula Digital PayPal supports international transactions without excessive fees or delays. This capability is ideal for businesses managing clients globally.

2. Secure Payments

Security remains a top priority. With Prince Narula PayPal, users are protected against unauthorized access and fraudulent activities through its robust encryption methods.

3. Versatile Integration

E-commerce platforms and freelance marketplaces can integrate this payment gateway effortlessly. Its APIs make onboarding and compatibility a breeze.

4. Instant Notifications and Reporting

Users receive real-time updates on payments, ensuring clarity in financial activities. Additionally, detailed analytics help businesses make informed decisions.

How to Get Started with Prince Narula Digital PayPal

Setting up your Prince Narula Digital PayPal account is straightforward. Follow these steps:

- Visit the Official Website: Go to the platform’s homepage.

- Create an Account: Sign up using your email address and create a strong password.

- Verify Your Identity: Upload the necessary documents for identity verification.

- Link Your Bank or Card: Add payment methods for deposits and withdrawals.

- Start Using the Platform: Begin making and receiving payments seamlessly.

By following these steps, users can start leveraging the platform’s features without hassle.

Industries Benefiting from Prince Narula Digital PayPal

Several industries have found immense value in adopting Prince Narula Digital PayPal, including:

E-Commerce

Online retailers benefit from easy payment integration and secure checkouts.

Freelancing

Freelancers can invoice clients worldwide with minimal transaction fees.

Travel and Hospitality

The platform’s support for multiple currencies ensures seamless bookings and payments.

Education

Educational institutions leverage this platform for fee collection and donations.

Advantages Over Competitors

When compared to other digital payment systems, Prince Narula PayPal stands out due to its innovative approach:

| Feature | Prince Narula Digital PayPal | Competitor A | Competitor B |

|---|---|---|---|

| Global Transactions | ✓ | ✓ | Limited |

| Security Protocols | Advanced | Basic | Advanced |

| Transaction Fees | Competitive | High | Moderate |

| User Interface | Intuitive | Complex | Moderate |

This table highlights how Prince Narula Digital PayPal remains a superior choice.

Challenges and Their Solutions

While no system is without challenges, Prince Narula Digital PayPal tackles them head-on:

- Initial Setup Complexity: Simplified guides and 24/7 support are available.

- Transaction Limits: Premium accounts offer higher limits.

- Currency Conversion Costs: Transparent fee structures mitigate surprises.

How Prince Narula PayPal Fosters Financial Inclusivity

Prince Narula Digital PayPal supports unbanked populations by offering virtual accounts and digital wallets. With mobile-first capabilities, even users without traditional banking access can transact securely.

Future Innovations in Prince Narula PayPal

As the platform evolves, expect exciting features such as:

- AI-Driven Insights: Personalized spending reports powered by AI.

- Blockchain Integration: Faster and tamper-proof transactions.

- Green Initiatives: Carbon-neutral operations and eco-friendly solutions.

Tips for Maximizing Prince Narula Digital PayPal Features

- Use multi-factor authentication to secure your account.

- Enable automatic currency conversion for cross-border payments.

- Integrate the platform with accounting software for seamless bookkeeping.

FAQs

What is Prince Narula PayPal?

Prince Narula PayPal is a modern payment platform designed for seamless, secure, and global transactions.

How does it ensure security?

It uses two-factor authentication, encryption, and fraud monitoring to protect user accounts.

Is it suitable for small businesses?

Absolutely! Its competitive fees and user-friendly integration make it ideal for small businesses and freelancers.

What are the fees associated with transactions?

Fees vary by region and transaction type, but they remain competitive compared to other platforms.

Can I link multiple bank accounts?

Yes, the platform allows linking multiple accounts for added flexibility.

Does it support cryptocurrency?

Upcoming updates may introduce cryptocurrency support as part of its innovation roadmap.

Conclusion

Prince Narula Digital PayPal is more than a payment platform—it is a game-changer in the digital financial space. Its blend of security, versatility, and user-centric design positions it as an essential tool for individuals and businesses alike. By adopting this innovative solution, users can enjoy seamless transactions while contributing to a future driven by efficiency and trust.